Venmo Online Gambling

Perhaps the best known example of this is PayPal’s Venmo, which has proven extremely successful in many parts of the world, including the United States. But other examples are also utilized by many. If you are made aware of a transaction using your Venmo account that you did not authorize, please send us a message through our contact form, email us at support@venmo.com, or chat with us in our mobile app. If you are reporting unauthorized activity on your Venmo Credit Card, please visit this page for information about freezing your Venmo. Venmo Sports Betting Bonuses Whenever you sign up at a legal online sportsbook – or whenever you make a fresh deposit into your account – you’ll be eligible to receive deposit-match bonuses that adds.

If you live in the United States, you can legally bet on sports online.

And best of all, you can do so whether or not your state has actually legalized domestic online sports betting!

While there are two exceptions (the states of Connecticut and Washington have laws against all forms of online gambling, though these are historically unenforced), residents in 48 of 50 states can lawfully bet real money on sports over the Internet.

The only caveat is that if there are no local options, they must use legal online sports betting sites that operate outside of US jurisdiction and hold legitimate licenses in their own home countries.

Nevertheless, there is usually one particular roadblock that prevents many USA gamblers from signing up with these operators, and that’s the online sports betting banking methods they support.

Due to the UIGEA gambling law that disallows domestic American banks from knowingly processing payments to and from non-US-regulated gambling outlets, credit and debit card deposits are sometimes declined.

While a declined payment does not mean you’ve committed any crime or that your card has been flagged or disabled, it’s an inconvenience that no sports bettor wants to face – especially when the day’s game kicks off in a few minutes and you need your account funded ASAP.

Many bettors think that an easy way to get their bankrolls topped off in a hurry would be to use P2P money transfer services like PayPal, Venmo, Cash App, and Zelle Pay.

However, in part due to the UIGEA and other restrictions, these companies do not allow such international transactions.

In the case of Venmo and Zelle Pay, these service are USA-only, which means there’s no way to use either to send or receive money to or from your offshore betting site of choice.

In the case of PayPal and Cash App, the former can be used for international transfers that are not gambling related, while the latter – though available in many countries – can only be used by parties physically inside those individual countries. International Cash App transfers are not allowed.

As these services are by far the most popular vehicles for person-to-person transactions, and since tens of millions of Americans use these services every day, international betting sites open to USA gamblers are at a decided disadvantage in not being able to process such payments.

However, that is no longer a problem!

At Bovada, the most popular online betting site in the United States, there is a brand-new deposit option that allows bettors to use PayPal, Venmo, Cash App, and Zelle to make rapid sportsbook deposits.

So, how is this possible, given the international limitations outlined above?

Because Bovada – as is their wont as an industry leader – now supports the new MatchPay betting deposit service, which makes it possible for US-based online gambling enthusiasts to finally deposit with the aforementioned P2P services.

What is MatchPay?

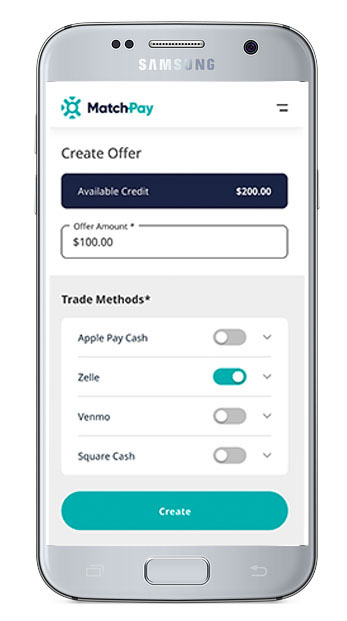

MatchPay is a third-party money transfer service that works in a unique and ingenious way.

Does Bovada Take Venmo

Essentially, MatchPay allows members at online retailers and merchants to sell their account balances – in part or in full – to other members at those same Internet storefronts.

While businesses must choose to participate in MatchPay’s program, the following is how MatchPay works for those that do. And since Bovada is the first online gambling site to support the platform, we’ll use Bovada MatchPay for our example below.

How MatchPay Works

Let’s say you want to sign up at Bovada but your credit or debit card has been declined, and you don’t want to make a Bitcoin gambling deposit because you’re not into the whole cryptocurrency scene.

However, you do have a PayPal account, and you’d prefer to make a PayPal betting deposit to fund your online wagers.

Normally, you’d be out of luck. SOL, even.

But with MatchPay, you can now use PayPal to transfer money to another Bovada member who has elected to put a portion of their account balance up on the MatchPay Trader service.

Once this player receives your PayPal payment (or other supported P2P payment) – which is overseen and guaranteed by both Bovada and MatchPay – your account will then be credited with the amount you’ve sent.

In short, MatchPay allows Bovada players to make easy account transfers using the world’s most popular payment platforms.

How To Deposit With MatchPay

While this is covered in detail at our MatchPay page linked above, the basics for how to deposit with MatchPay are simple to understand.

First off, of course, you will need an account at Bovada, as Bovada Sportsbook is the only legal online betting site that currently offers support for the platform.

Once you’re a member at Bovada, simply log in, go to the deposit section of your account portal, and select the MatchPay option. (Alternatively, new members can select this deposit method during the sign-up process itself.)

There, you’ll be asked to enter your MatchPay Trader ID, and you’ll be able to use the site’s plug-in to sign up for MatchPay if haven’t already. The service is free, and joining takes about two minutes.

Then, simply enter the amount of money you’d like to add to your account via the MatchPay service.

Venmo Online Gambling Sites

Next, MatchPay automatically pairs you with a Bovada member who is also a MatchPay Trader, to whom you can send the requisite funds by using any of the following P2P services:

- PayPal

- Venmo

- Cash App

- Zelle Pay

Once your funds clear and the Bovada member receives your money, Bovada will transfer the appropriate account balance from their sportsbook account to your sportsbook account, and you’ll be ready to wager.

The entire process to deposit with MatchPay takes 10-15 minutes, and these deposits come with the standard sportsbook bonuses and membership perks you expect.

Ultimately, MatchPay is a true gamechanger in a market where those are few and far between. Kind of like Patrick Mahomes.

And though we still think that crypto deposits (Bitcoin, Bitcoin Cash, Litecoin, Ethereum, etc.) are the way to go long-term, there are potentially millions of sports betting fans out there who will benefit from MatchPay allowing them to make PayPal sportsbook deposits, Venmo sportsbook deposits, Cash App sportsbook deposits, and Zelle sportsbook deposits.

Further, because MatchPay opens the door to a whole new class of clientele that wasn’t able to deposit and bet before, it’s only a matter of time before the entire industry adopts MatchPay or similar services for their customers.

If you ever wanted to bet on sports with PayPal or another popular P2P instant-pay app, now you finally can!

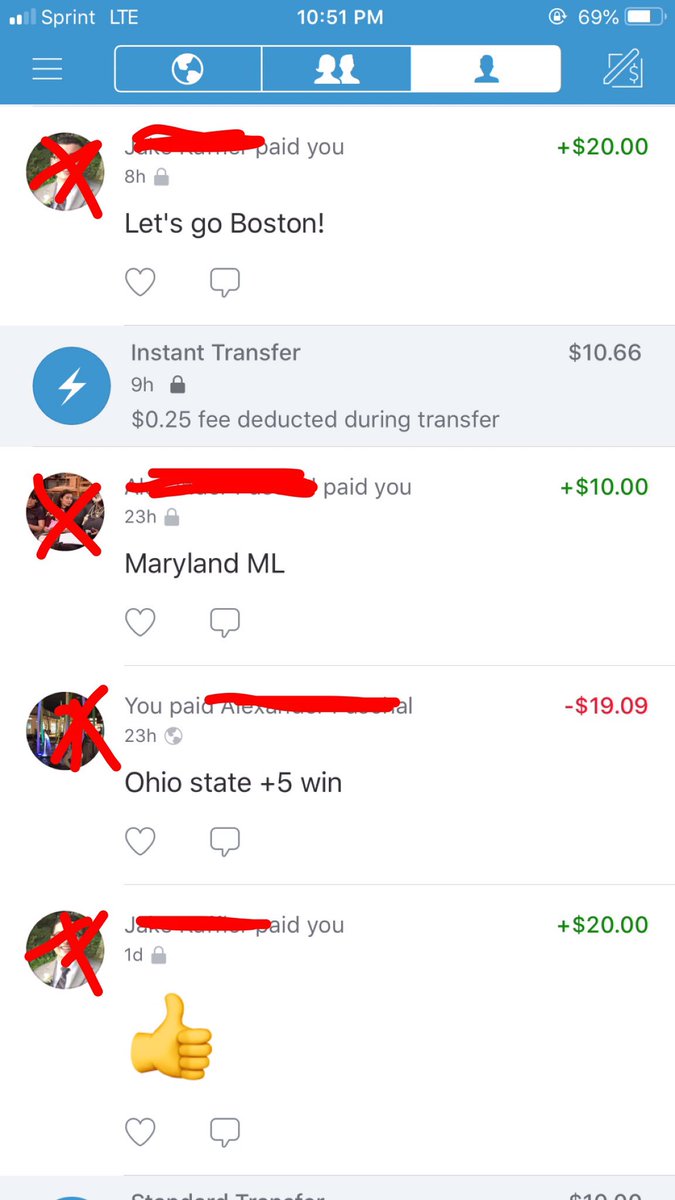

If you checked your Venmo feed last Sunday between 6pm and midnight, you might have noticed that it was awash with Super Bowl-related transactions, from the semi-innocuous 'tom brady is bad bye!!!!!!!!!,” to the more, uh, sus 'Rigging the Super Bowl.” Venmo told The Outline Sunday in no uncertain terms that gambling on sports through Venmo is not only broadly illegal in most places in the US, but against the company's terms of service. According to research done by The Outline using the transaction data available through Venmo’s public API, on average 44 percent of Sunday night's transactions included messages with Super-Bowl-related terms and 14 percent directly referenced gambling.

All Venmo transactions require a message of some sort, and they’re generally pretty transparent. Inspired in part by Vicemo — the website that provides a comprehensive list of every public Venmo transaction accompanied by a vice-related message (like, a bunch of tree emojis, “drank,” “drugs,” or, of course, the ever popular “drugz”) — I sampled transactions for the messages listed in Venmo’s public API against a variety of Super Bowl keywords (“football,” “Super Bowl,” “fucktomb,” etc.) and gambling-related keywords (“squares,” “prop,” or “bet,” as in, “In hindsight, maybe betting the mortgage on the Patriots wasn’t the best idea”) keywords in order to get a rough estimate of the number of people who used Venmo for possibly illegal purposes last night.

Based on my research, there were about 139,500 Venmo transactions occurring per hour, which evens out to approximately 837,100 Venmo transactions over the course of the evening. Forty-four percent of these transactions were obviously related to the Super Bowl in some way, and at its peak in the minutes after the game ended, 14 percent of transactions explicitly referenced gambling (i.e. 'Refund for super bowl squares,” “illegal super bowl gambling”), with an 8 percent average overall.

I’m guessing (hoping?) that a sizable portion of Super Bowl Sunday betters were a little less conspicuous with their payments. Regardless, there was likely anywhere from 65,000 to 370,000 Super Bowl gambling-related transactions on Venmo Sunday night. This is all, mind you, illegal in most states and totally against Venmo’s Terms of Service.

Despite the fact that Venmo staffed its HQ specifically for this event, the app still experienced a considerable amount of lag directly after the big game. Lots of users took to Twitter to point the finger at gamblers, who they alleged had overwhelmed the app with Super Bowl-related payouts.

Why is Venmo so slow? Is it because everyone is using it to pay off lost bets?

— Caleb Kaslik (@calebkaz96) February 5, 2018

— Caleb Kaslik (@calebkaz96) February 5, 2018My entire Venmo timeline is people losing money on the Super Bowl.

— Jack Falahee (@RestingPlatypus) February 5, 2018While the Super Bowl is Venmo’s biggest day of the year, it’s certainly not the only day its users appear to gamble: An analysis by Quartz in 2017 showed that up to a third of the transactions on the whole service appeared to be gambling-related on the morning of the first March Madness game. Venmo did not respond to a request for comment.